NSSF Deductions in Kenya

The National Social Security Fund (NSSF) in Kenya is a government-mandated social security scheme designed to provide financial security to workers upon retirement. Established under the NSSF Act, the fund operates as a compulsory savings plan where both employees and employers contribute a portion of an individual’s salary towards retirement benefits. The scheme ensures that Kenyan workers have access to financial assistance in their old age, disability, or unforeseen circumstances such as the loss of a breadwinner.

NSSF functions as a pension fund where contributions are accumulated over a worker’s employment period and later disbursed as benefits. The fund is managed under the oversight of the Retirement Benefits Authority (RBA) to ensure compliance with pension regulations and to safeguard contributors’ savings.

Importance of NSSF Deductions for Retirement Benefits

NSSF deductions play a crucial role in securing an individual’s financial future. Without a structured pension system, many retirees in Kenya risk financial instability after their working years. The importance of NSSF deductions includes:

- Retirement Security: Ensures individuals have funds to support themselves post-retirement.

- Social Protection: Provides financial support in cases of disability or survivor benefits for dependents.

- Employer-Employee Shared Responsibility: The scheme requires both employers and employees to contribute, ensuring a collective effort towards financial stability.

- Compliance with Employment Laws: Employers are legally required to deduct and remit NSSF contributions, promoting formal savings culture among workers.

Who is Required to Contribute?

NSSF contributions apply to a broad category of workers in Kenya, including:

- Formal Employees: All employees working in the formal sector under permanent or contract employment must contribute. Their employers are responsible for deducting and remitting their NSSF contributions.

- Employers: Businesses and organizations hiring employees are legally obligated to contribute an equal amount on behalf of their employees.

- Self-Employed Individuals: Individuals running their own businesses or working in the informal sector can opt to contribute voluntarily under the NSSF voluntary scheme.

- Government Employees and Civil Servants: Though some government employees have alternative pension schemes, many still contribute to NSSF, especially those under contractual employment.

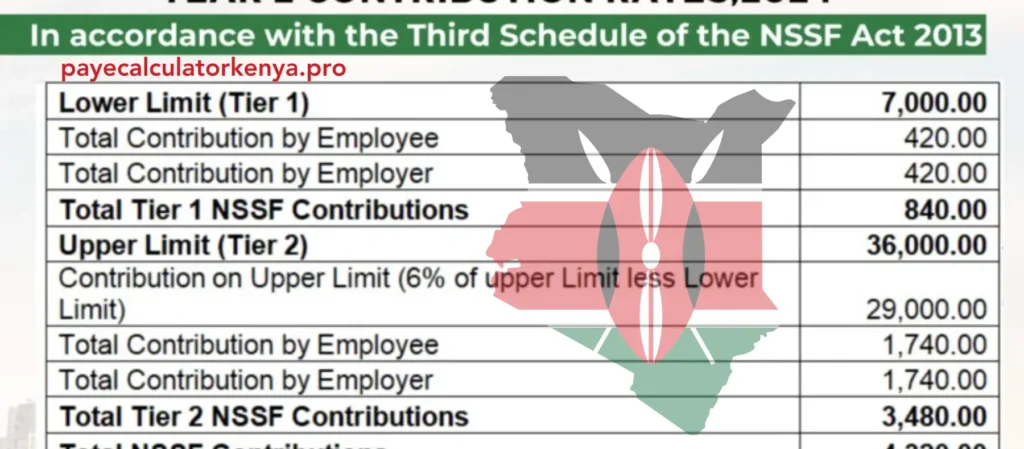

Updated NSSF Contribution Rates for 2024

As per the latest updates, NSSF contributions in Kenya are structured under the NSSF Act of 2013, which introduced a two-tier contribution system aimed at enhancing retirement benefits. The updated contribution rates for 2024 are categorized into:

- Tier I Contributions: Based on the lower earnings limit, typically targeting lower-income earners.

- Tier II Contributions: Applied to earnings exceeding the Tier I limit, mainly covering middle and high-income earners.

These rates are reviewed periodically to ensure that they align with Kenya’s evolving economic landscape and cost of living.

2. Understanding NSSF Deductions in Kenya

What Are NSSF Deductions?

NSSF deductions refer to the mandatory pension contributions deducted from an employee’s salary every month and matched by their employer. These deductions are channeled into the worker’s pension account and invested to generate returns, which are later disbursed as benefits upon retirement, disability, or other qualifying circumstances.

The deductions are computed as a percentage of an individual’s gross salary, meaning the higher the salary, the higher the contributions. The purpose of these deductions is to ensure that employees save regularly for their future financial security.

Breakdown of Tier I and Tier II Contributions

NSSF contributions in Kenya are structured into two categories based on income brackets:

1. Tier I Contributions

- Applies to employees earning up to the Lower Earnings Limit (LEL).

- The current Lower Earnings Limit is KSh 6,000 per month.

- Both the employee and employer contribute KSh 360 each, totaling KSh 720 monthly.

2. Tier II Contributions

- Applies to earnings exceeding the Lower Earnings Limit (LEL).

- The Upper Earnings Limit (UEL) is KSh 18,000 per month.

- Employees and employers each contribute KSh 720, totaling KSh 1,440 monthly.

How Deductions Are Calculated

NSSF deductions are calculated as a percentage of an employee’s gross monthly earnings, with different rates applied based on whether an employee falls under Tier I or Tier II contributions.

- Identify the gross salary of the employee.

- Determine the applicable tier (Tier I for lower-income earners, Tier II for higher-income earners).

- Apply the NSSF rate for both the employee and employer.

- Ensure the total contribution is remitted before the due date to avoid penalties.

For instance, if an employee earns KSh 18,000 per month, their NSSF deduction will be structured as follows:

- Tier I: Employee contributes KSh 360, employer matches with KSh 360.

- Tier II: Employee contributes KSh 720, employer matches with KSh 720.

- Total Monthly Contribution = KSh 2,160 (KSh 1,080 from the employee + KSh 1,080 from the employer).

NSSF Act of 2013 and Recent Changes

The NSSF Act of 2013 restructured the old pension system in Kenya by increasing contribution rates and introducing Tier I and Tier II categories. Some key changes brought by the Act include:

- Higher Contributions: Previously, employees contributed only KSh 200 per month. The Act significantly increased contributions to better secure retirement benefits.

- Employer Matching: Employers are required to match employee contributions shilling-for-shilling, ensuring a sustainable pension plan.

- Voluntary Contributions: The Act allows self-employed individuals to join the scheme and make voluntary contributions to build their pension savings.

- Expanded Coverage: NSSF membership was extended to informal sector workers and small businesses, encouraging wider pension participation.

- Pension Scheme Classification: NSSF was restructured to align with global pension fund standards, allowing better investment management of contributions.

NSSF Contribution Breakdown for Employees & Employers (2024)

| Category | Employee Contribution | Employer Contribution | Total Contribution |

|---|---|---|---|

| Tier I | KSh 360 | KSh 360 | KSh 720 |

| Tier II | KSh 720 | KSh 720 | KSh 1,440 |

| Total | KSh 1,080 | KSh 1,080 | KSh 2,160 |

This table summarizes the total deductions made under the current NSSF contribution structure. Both employers and employees must ensure that these contributions are deducted and remitted on time to comply with Kenya’s pension laws.

Calculating NSSF Deductions in Kenya

Calculating NSSF deductions accurately ensures compliance with statutory requirements while securing retirement benefits. The process follows a structured approach based on an employee’s gross salary, which determines the contribution tier and amount. Below is a detailed step-by-step guide for computing NSSF deductions.

Step 1: Identify Your Monthly Gross Salary

The gross monthly salary is the foundation for NSSF deduction calculations. This amount includes all earnings before deductions such as PAYE (Pay As You Earn) tax, NHIF contributions, and other statutory deductions.

Key components of gross salary:

- Basic salary, which is the fixed monthly wage

- Housing allowance, if provided by the employer

- Bonuses and commissions, where applicable

- Overtime pay, if considered part of taxable income

It is important to use the actual gross salary before tax deductions, as NSSF contributions are based on this figure.

Step 2: Determine Which Tier You Fall Under

NSSF contributions in Kenya follow a tiered structure based on salary brackets:

- Tier I: Employees earning up to KSh 6,000 per month contribute under this category.

- Tier II: Employees earning above KSh 6,000 and up to KSh 18,000 contribute to both Tier I and Tier II.

Examples of tier classification:

- If an employee earns KSh 4,500, they fall under Tier I only.

- If an employee earns KSh 10,000, they contribute to both Tier I and Tier II.

- If an employee earns more than KSh 18,000, the Tier II contribution is capped at the maximum amount.

The applicable tier determines the exact deduction percentage and the employer’s matching contribution.

Step 3: Apply the NSSF Deduction Rate

After determining the contribution tier, the NSSF deduction rate is applied. Contributions are calculated as a fixed percentage of the employee’s salary, with the employer required to match the amount.

NSSF Deduction Breakdown (2024):

| Category | Employee Contribution | Employer Contribution | Total Contribution |

|---|---|---|---|

| Tier I | KSh 360 | KSh 360 | KSh 720 |

| Tier II | KSh 720 | KSh 720 | KSh 1,440 |

| Total | KSh 1,080 | KSh 1,080 | KSh 2,160 |

Example Calculation:

For an employee earning KSh 12,000, the NSSF deductions will be:

- Tier I: KSh 360 (employee) + KSh 360 (employer) = KSh 720

- Tier II: KSh 720 (employee) + KSh 720 (employer) = KSh 1,440

- Total Monthly Contribution: KSh 2,160

A graphical representation of contributions based on salary brackets can help employees understand the deduction structure.

Step 4: Employer Matches the Contribution

Employers are legally required to match their employees’ NSSF contributions. This means that:

- For every KSh 1,080 deducted from an employee’s salary, the employer adds an equal amount.

- The total contribution remitted to NSSF is doubled, enhancing the employee’s retirement savings.

- Employers must remit the full amount on time to avoid penalties and compliance issues.

Step 5: Check Your NSSF Contributions via the Self-Service Portal

Employees should regularly verify that their contributions are correctly deducted and remitted. This can be done through the NSSF Self-Service Portal, which provides real-time updates on contributions.

How to Access Your NSSF Statement:

- Visit the official NSSF website at www.nssf.or.ke

- Click on “Self-Service Portal”

- Log in using the NSSF Member Number and Password

- Navigate to “My Contributions”

- Select “View Statement” to check recent deductions

Regularly reviewing NSSF contributions ensures there are no discrepancies and that employers are remitting the correct amount.

How to Check Your NSSF Contributions Online

Tracking NSSF contributions online is an essential step in managing retirement savings. Employees can monitor their accounts via the NSSF e-service portal, which provides an easy way to check contribution records, download statements, and resolve any issues.

Step-by-Step Guide to Accessing the NSSF E-Service Portal

- Visit the NSSF Website

- Open a web browser and go to www.nssf.or.ke

- Select “Self-Service Portal”

- Click the Member Login section for individual employees

- Employers should choose the Employer Login option

- Log In or Register

- First-time users must register using their NSSF Member Number, ID, and email

- Returning users can log in using their username and password

- View Your Contribution History

- Navigate to “My Contributions” to see a breakdown of payments

- Check both employee and employer contributions for accuracy

- Download the NSSF Contribution Statement

- Click on “Download Statement” to save a PDF copy of the contribution history

This digital record serves as proof of compliance and is essential when claiming benefits upon retirement.

Common Issues and Solutions When Checking Contributions

Issue 1: Forgotten Password or Login Issues

Solution: Use the “Forgot Password” option on the portal to reset credentials.

Issue 2: Missing Contributions

Solution: Contact the employer to confirm remittance dates. If unresolved, visit an NSSF branch with payslips.

Issue 3: Incorrect Contribution Amounts

Solution: Cross-check gross salary deductions and the NSSF tier calculation. Raise disputes through NSSF customer service if necessary.

5. Benefits of NSSF Deductions in Kenya

NSSF deductions provide social security protection for Kenyan workers by offering financial benefits upon retirement, disability, or death. These contributions play a crucial role in securing an individual’s future and providing support for their dependents. Below is a breakdown of the key benefits.

Retirement Benefits – Secure Pension Income

The primary objective of NSSF is to provide pension income upon retirement. Once a member reaches the eligible retirement age (currently 60 years), they can access their accumulated contributions plus interest. This pension ensures financial stability in old age, reducing reliance on family members or government support.

Invalidity Benefits – Protection in Case of Disability

If a contributor becomes permanently disabled and unable to work, NSSF provides financial support in the form of invalidity benefits. The member must provide medical proof of disability to qualify. This benefit ensures continued income for those who are unable to sustain employment due to health challenges.

Survivors Benefits – Support for Dependents in Case of Death

In the unfortunate event of a contributor’s death, NSSF pays out survivors’ benefits to the deceased member’s dependents, including spouses, children, or nominated beneficiaries. This financial assistance helps dependents cope with loss and maintain their financial well-being.

Withdrawal Benefits – Options for Those Changing Employment

Members who stop working, switch to self-employment, or move abroad may qualify for withdrawal benefits. Depending on the circumstances, they can access a portion of their NSSF savings. The withdrawal process requires proper documentation and approval from NSSF.

Funeral Grants – Assistance for Family Members

NSSF provides financial support to the family of a deceased contributor to help cover funeral expenses. This grant eases the burden of funeral costs, ensuring dignified arrangements for the deceased.

Pros and Cons of NSSF Contributions

Like any social security system, NSSF has advantages and challenges. Below is a comparison of its key pros and cons.

| Pros | Cons |

|---|---|

| Provides retirement security | Mandatory for employees |

| Employers contribute equally | Limited investment options |

| Covers disability and death benefits | Some delays in processing claims |

6. How Employers Should Process NSSF Deductions in Kenya

Employers play a crucial role in ensuring NSSF deductions are made correctly and submitted on time. Failure to comply with these obligations can result in penalties and legal consequences. Below is a step-by-step guide for employers to process NSSF deductions.

Payroll Deduction Process

- Calculate the NSSF deductions for each employee based on their gross salary and applicable tier.

- Deduct the employee’s contribution from their salary before disbursing wages.

- Match the employee’s contribution with an equal amount from the employer.

- Remit the total contributions to NSSF by the due date (typically before the 9th of the following month).

NSSF Compliance & Penalties for Non-Compliance

Employers must comply with NSSF regulations, including timely remittance of contributions. Failure to remit deductions on time may result in penalties, including:

- 5% penalty on late payments per month

- Legal action by NSSF for non-compliance

- Additional fines imposed by the authorities

Filing NSSF Contributions Through eCitizen or NSSF Portal

Employers can submit NSSF payments electronically using the following platforms:

- eCitizen Portal: Employers can log in, file contributions, and generate a payment slip.

- NSSF Employer Portal: This platform allows direct submission and tracking of payments.

- Bank Payments: Employers can pay through designated NSSF partner banks.

7. How Self-Employed Individuals Can Register and Contribute to NSSF

Self-employed individuals are encouraged to voluntarily contribute to NSSF to secure their retirement benefits. The process is straightforward and accessible through various platforms.

Registration Process for Voluntary Contributors

- Visit the nearest NSSF office or register online through the NSSF portal.

- Submit the required documents, including a national ID and KRA PIN.

- Receive an NSSF membership number and account details.

Minimum Monthly Contribution for Self-Employed Individuals

Self-employed members contribute a minimum of KSh 200 per month but can choose to contribute more based on their earnings. These voluntary contributions accumulate over time, ensuring future financial security.

How to Remit Payments via M-Pesa PayBill and Bank Deposits

- M-Pesa PayBill:

- Go to M-Pesa menu and select “Lipa na M-Pesa”

- Enter PayBill number 333300

- Use your NSSF member number as the account number

- Enter the amount and confirm the transaction

- Bank Deposits: Payments can be made through designated NSSF partner banks.

8. NSSF Deductions and Tax Benefits in Kenya

NSSF contributions provide tax relief benefits for employees by reducing their taxable income.

How NSSF Contributions Are Tax Deductible

Under the Income Tax Act (Cap 470), NSSF contributions are tax-deductible, meaning they reduce an employee’s taxable income. This results in lower PAYE tax liability.

Impact on PAYE (Pay As You Earn) Calculations

The PAYE tax is applied on an employee’s income after deducting NSSF contributions. This reduces the taxable amount, leading to lower tax payments.

Tax Reliefs for Pension Contributions

- Employees contributing to both NSSF and private pension schemes can claim tax relief.

- The tax-deductible pension contribution limit is KSh 20,000 per month or KSh 240,000 per year.

9. Common Questions and Misconceptions About NSSF Deductions in Kenya

Many employees and employers have questions about how NSSF deductions work. Below are answers to some of the most frequently asked questions.

Can I Withdraw My NSSF Savings Before Retirement?

Yes, but only under specific conditions, such as disability, emigration, or when switching to a pension scheme that meets NSSF requirements.

What Happens if I Stop Contributing?

If an employee stops contributing due to unemployment or job change, their savings remain intact until they qualify for withdrawal benefits. Self-employed individuals can resume voluntary contributions at any time.

Can an Employer Refuse to Deduct NSSF?

No. Employers are legally required to deduct and remit NSSF contributions. Failure to do so results in penalties and legal action.

How Do I Update My NSSF Details?

To update NSSF details, visit an NSSF office with supporting documents such as ID, KRA PIN, and employment records. Changes can include updating personal details, dependents, or contact information.

10. Conclusion & Final Thoughts

NSSF deductions play a vital role in securing financial stability for employees after retirement. Both employees and self-employed individuals should actively contribute and track their savings to ensure they maximize their benefits.

To remain compliant:

- Employers should process contributions accurately and on time.

- Employees should regularly check their NSSF statements to confirm proper deductions.

- Self-employed individuals should register and contribute consistently to secure their future.

Planning for retirement early through NSSF contributions ensures financial security, reducing dependency on others in old age. Whether employed or self-employed, understanding how NSSF deductions work is crucial for long-term financial planning.