KRA iTax P10 Filing

Kenya’s tax authority (KRA) now requires businesses to file employee PAYE returns online through iTax. Instead of manual submissions, KRA now requires businesses to file employee PAYE returns online through iTax.

Exporting iTax Data

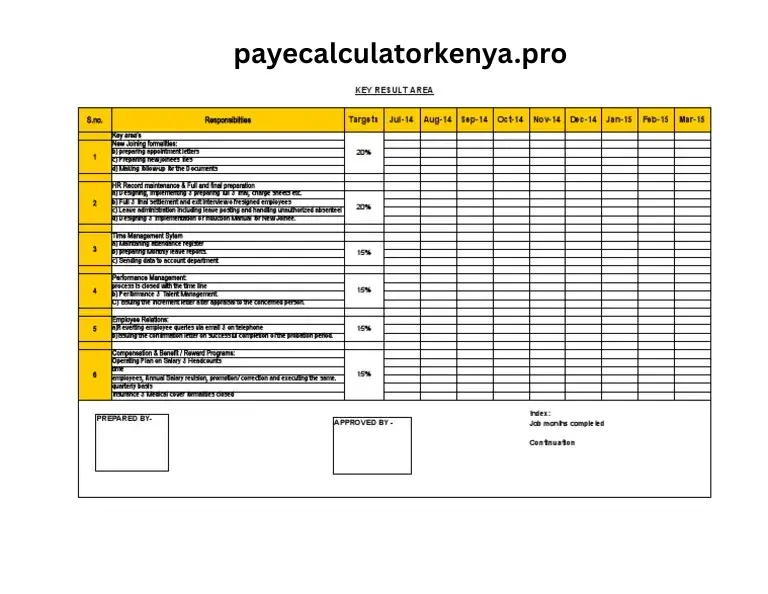

Two files are needed for P10 returns:

- Employee Details: Regular employees (no disability exemptions).

- Disabled Employee Details: Employees with disability exemptions.

Steps:

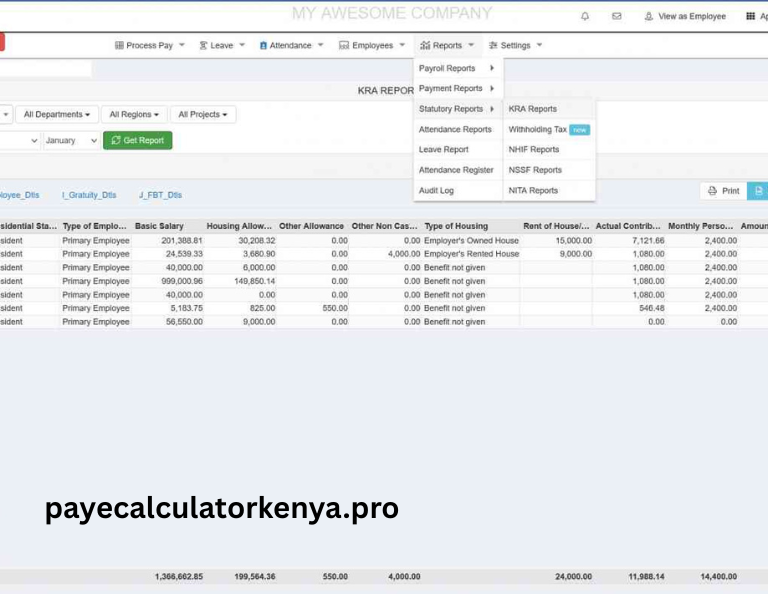

- In Wingubox, go to Payroll Main Menu > Reports > Statutory Returns > KRA Reports.

- Select the latest payroll month (default) and click the blue “Download iTax CSV” button.

Employee Details

- Download: Save the Wingubox-generated CSV file.

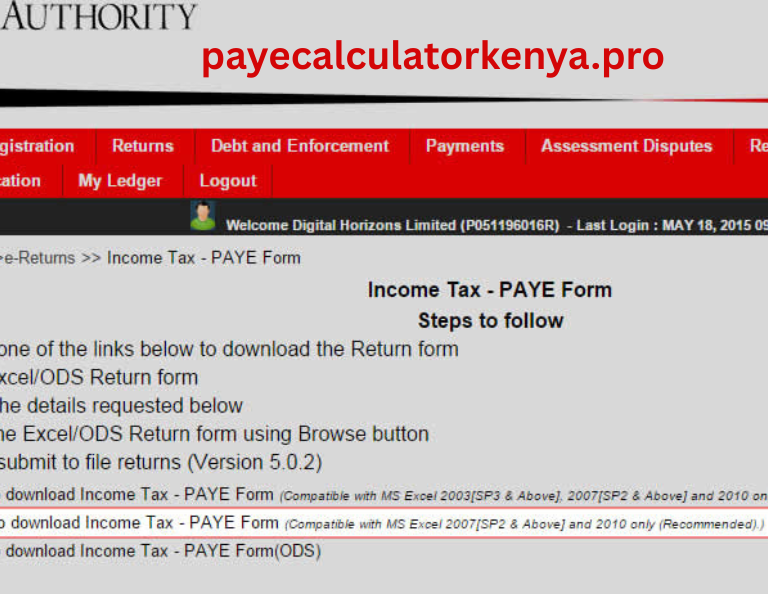

- Open KRA’s Excel Sheet: Use P10_Return.xlsm (download it from KRA iTax).

- Basic Info: Fill in your company’s PIN and tax period on the first tab. Click Next.

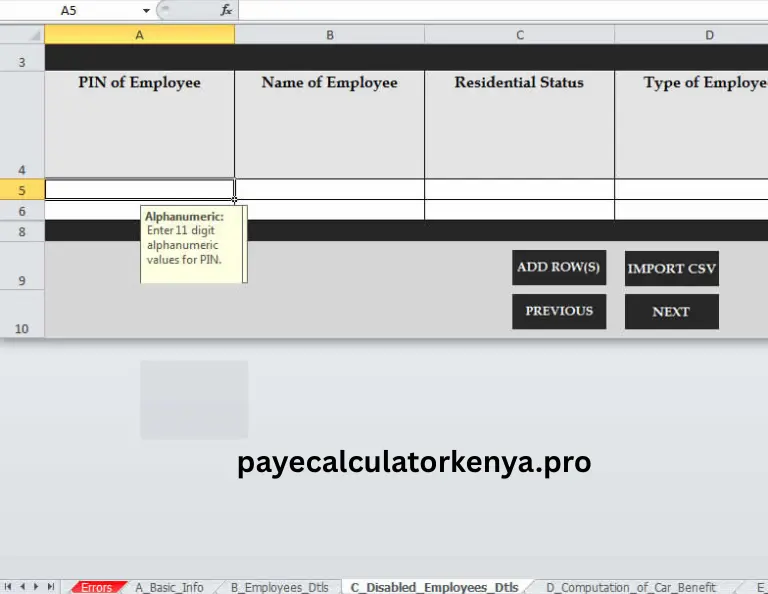

- Import CSV: On the Employee Details tab, click “IMPORT CSV” to upload your Wingubox file. The data will populate automatically.

- Verify: Check columns AH & AI (KRA’s PAYE vs. your payroll numbers).

Disabled Employee Details

- In Wingubox, click “Export KRA Report” and choose “iTax Disabled Employees”. Save the CSV.

- In KRA’s Excel sheet, go to the C_Disabled_Employee_Dtls tab and repeat the “IMPORT CSV” step.

Common Causes for Errors

- Missing Employee PIN: Ensure every employee has a valid KRA PIN.

- Missing Exemption Certificate: Disabled employees need an exemption number.

- Typos: Double check names, IDs, and amounts before uploading.